As we approach the budgeting season for 2026, the dreaded question will soon be asked:

“What 2026 salary increase can we use for the Nigeria budget?”

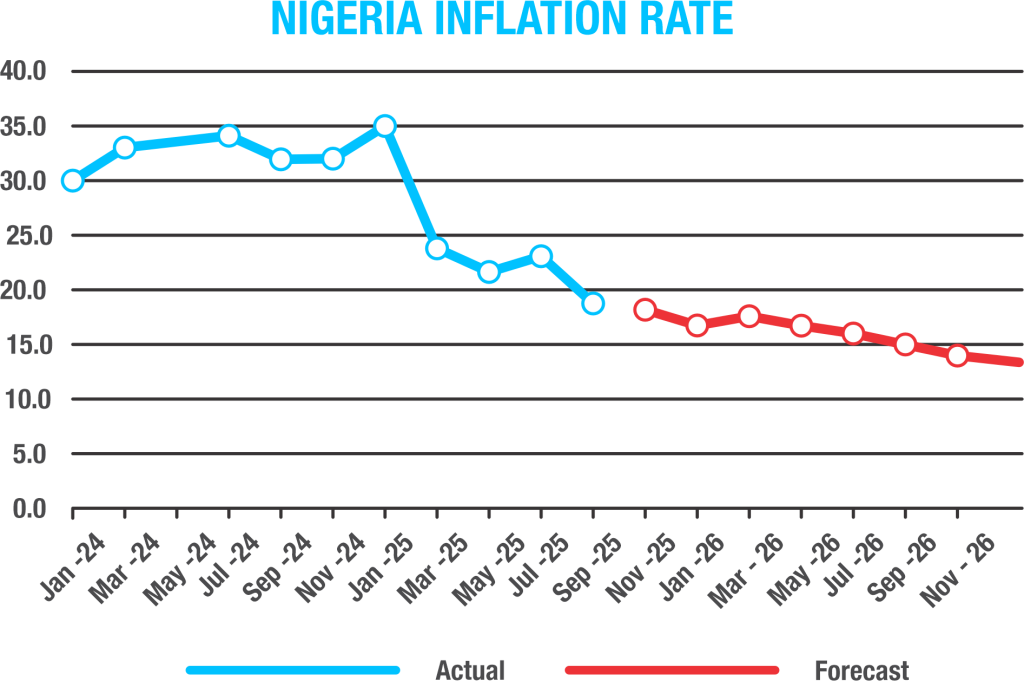

Implementing a salary increase that is fair to all stakeholders in Nigeria has been a significant challenge in recent years. The primary reason has been the persistently high inflation rate. In 2024, the average inflation was 33.2%, and we forecast an average of 21.06% for 2025.

Clearly, most companies we not able to match inflation with equivalent salary increases. In response, we previously recommended that employers consider introducing an Inflation Allowance to help mitigate the impact on employees. (You can view that article by clicking here.)

Considering Real Salary Growth

In addition to inflation, it’s important to factor in real salary increases. Employees have experienced negative real wage growth in both 2024 and 2025. Unfortunately, we are only forecasting 3.9% GDP growth for 2026, which suggests limited room for aggressive salary increases without impacting company profitability.

Considering Real Salary Growth

There is cautious optimism that 2026 may be more manageable. The graph below illustrates historical inflation trends alongside our forecast for 2026:

- Average inflation forecast for 2026: 16.05%

- Expected inflation by end of 2026: 14.5%

While inflation in Nigeria remains difficult to predict, we are confident it will continue to decline throughout 2026. This view is supported by the Monetary Policy Committee (MPC), which stated at its 23 September meeting:

“Staff projections suggest a sustained disinflation over the coming months, driven by the lagged effects of previous rate hikes, continued stability in the foreign exchange market, and a decline in the price of PMS.”

Recommendation

Based on our analysis of inflation trends, economic growth, and employee welfare, we recommend a salary increase of 16.5% for 2026. This figure aims to balance affordability for employers with the need to restore purchasing power for employees.

We recently formulated our preliminary salary forecast for Ghana – another country which presented immense problems over the last two years – you can read that article by clicking here.

Ready to Finalise Your 2026 Budget?

Need assistance with your 2026 Nigeria payroll and budget planning? Contact us today to discuss how to implement a fair and affordable salary increase strategy.

COOKIE POLICY

Welcome to our website.

1. Introduction

This Cookie Policy explains how we use cookies and similar technologies on our website axioconsult.com. This policy is designed to help you understand what cookies are, how we use them, and the choices you have regarding their use.

2. What Are Cookies

Cookies are small text files that are stored on your device (computer, tablet, or mobile phone) when you visit certain websites. They are widely used to enhance your online experience by remembering your preferences and actions over time. Cookies are not harmful and do not contain personal information like your name or payment details.

3. How We Use Cookies

We use cookies for various purposes, including:

- Essential Cookies: These cookies are necessary for the basic functioning of our website. They enable you to navigate our site, use its features, and access secure areas.

- Analytical/Performance Cookies: These cookies help us understand how visitors use our website. They provide information about which pages are visited most frequently, how long visitors stay on each page, and whether they encounter any error messages. This data helps us improve the performance and usability of our website.

- Functionality Cookies: These cookies allow our website to remember choices you make (such as your username, language, or region) and provide enhanced, personalised features.

- Targeting/Advertising Cookies: These cookies are used to deliver advertisements that are relevant to your interests. They may also limit the number of times you see an ad and help measure the effectiveness of ad campaigns.

4. Your Cookie Choices

You have the option to manage your cookie preferences. You can usually modify your browser settings to accept, reject, or delete cookies. Please note that if you choose to block or delete cookies, some features of our website may not function properly.

5. Third-Party Cookies

We may allow third-party service providers to use cookies on our website for the purposes outlined in Section 3. These providers may also collect information about your online activities over time and across different websites.

6. Updates to This Policy

We may update this Cookie Policy from time to time to reflect changes in technology, law, or our data practices. Any changes will become effective when we post the revised policy on our website.

7. Contact Us

If you have any questions about our Cookie Policy or how we use cookies on our website, please contact us at

By continuing to use our website, you consent to the use of cookies as described in this Cookie Policy.